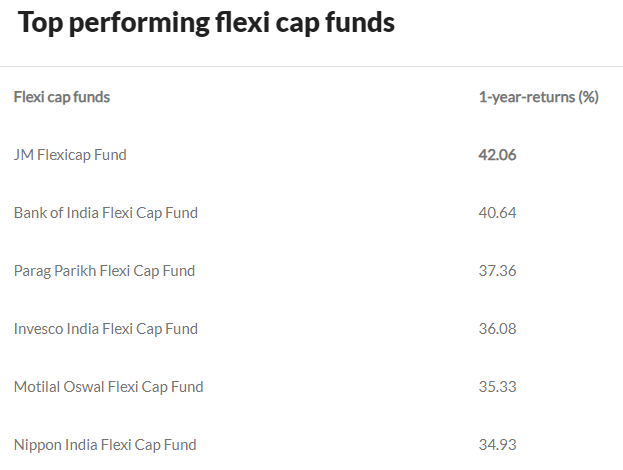

5 flexi cap mutual funds gave over 35% return in the past one year. Details here

Before deciding to invest in a mutual fund scheme, investors tend to weigh a number of considerations such as the scheme’s category, reputation of the fund house and the past performance of fund managers who are managing the scheme, among others. However, one of the key factors which determines whether a mutual fund scheme is worthy of investment or not, is the past performance. Investment advisors of multiple hues often assert that the historical returns do not guarantee the returns in future, yet they play an important role in drawing more investors, and also in retaining the existing ones. For instance, a mutual fund which is making the most of a bull run and giving a high return is seen as a good investment option. Conversely, a scheme which has lagged the benchmark index return is not seen as a good investment option. Here we zero in on the top-performing flexi cap mutual fund schemes which have delivered over 30 percent on investment in the past one year. What are flexi cap mutual funds? Flexi cap mutual funds offer investors the flexibility to invest across market capitalisations, including large, mid, and small-cap companies. According to Sebi’s categorisation of mutual funds, flexi cap funds refer to the schemes which have invested a minimum of 65 percent in equity & equity-related instruments. As we can see in the table above, there are five schemes which have delivered more than 35 percent return in the past one year. These are JM Flexicap Fund, Bank of India Flexi Cap Fund, Parag Parikh Flexi Cap Fund, Invesco India Flexi Cap Fund and Motilal Oswal Flexi Cap Fund. The lone scheme, which has barely earned over 30 percent in the past one year is Edelweiss Flexi Cap Fund with 30.82 percent return. It is imperative to reiterate that regardless of high returns given in the recent past, future returns are not guaranteed by any of these schemes as they will be determined by an interplay of several factors such as the state of economy, overall direction of the #market index, among others. Source - Mint

- 0

- 0

- ₹0