Explained: Why ₹ 2,000 Note Was Introduced, And Why It's Being Junked

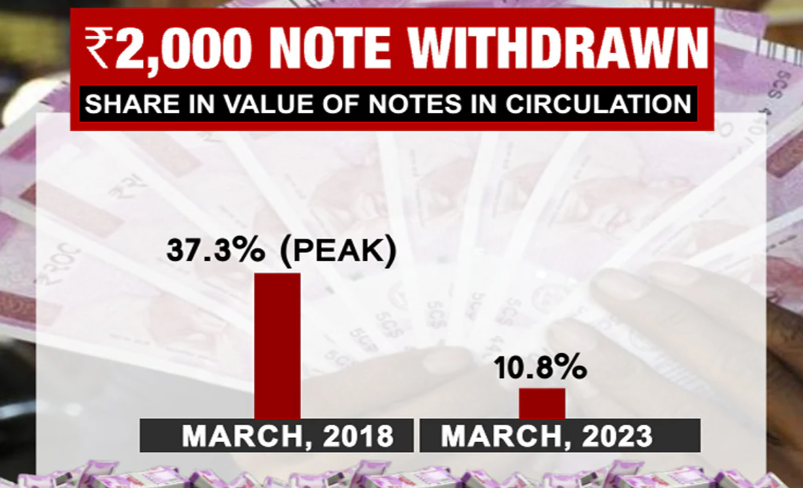

₹ 2,000 Notes Withdrawn: A majority (89 per cent) of the ₹ 2,000 notes were issued before March 2017, and are at the end of their estimated life span of four to five years. The ₹ 2,000 banknote was introduced in November 2016 under Section 24(1) of the RBI Act, 1934 -- which allows the central bank to issue notes of any denomination not exceeding ₹ 10,000 -- primarily to meet the currency requirement of the economy "in an expeditious manner" after the big demonetisation exercise, in which the legal tender status of all ₹ 500 and ₹ 1,000 banknotes in circulation at that time was withdrawn, the Reserve Bank of India has said. "With fulfilment of that objective and availability of banknotes in other denominations in adequate quantities, printing of ₹ 2000 banknotes was stopped in 2018-19," RBI said. RBI Governor Shaktikanta Das today said the exercise is part of the "currency management system" of the central bank, and "there's no reason to rush to banks" as people have four months to change or deposit ₹ 2,000 notes. Mr Das said the bank expects most notes to come back. "We will decide what to do next after September 30. But it will continue as legal tender," he said and assured the people, even those living in foreign countries, that the RBI will be sensitive to all their problems. Rs 2,000 notes in numbers A majority (89 per cent) of the ₹ 2,000 notes were issued before March 2017, and are at the end of their estimated life span of four to five years, the central bank said, highlighting that ₹ 2,000 notes are not commonly used for transactions. "The total value of these banknotes in circulation has declined from ₹ 6.73 lakh crore at its peak as on March 31, 2018 (37.3% of Notes in Circulation) to ₹ 3.62 lakh crore constituting only 10.8% of Notes in Circulation on March 31, 2023," RBI said. Sourec - NDTV

- 0

- 0

- ₹0