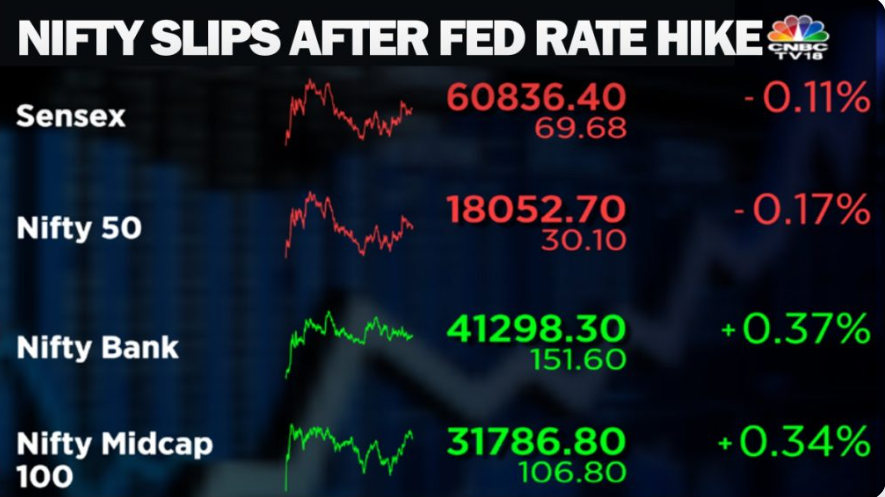

Trade setup for Nov 4: As D-Street digests Fed action, Nifty50 may test 18,200 again soon

Experts say the absence of sharp weakness at crucial resistance near 18,200 is a good sign. Here's what the technical charts suggest. Indian equity benchmarks slipped into the red amid a global sell-off after the Fed delivered a hike of 75 basis points in the benchmark interest rate along expected lines but Chair Jerome Powell's signal at more increases than anticipated earlier spooked investors. has formed a small positive candle on the daily chart with a minor upper shadow, indicating a buy-on-dips opportunity at the highs , according to Nagaraj Shetti, Technical Research Analyst at HDFC Securities. MSCI's broadest index of Asia Pacific shares outside Japan was up 1.5 percent at the last count. The maximum put open interest is at 18,000, with more than two lakh contracts, and at 17,700 and 17,500, with 1.2 lakh each. Source - NDTV #nifty50 #stock #market

- 4

- 0

- ₹0